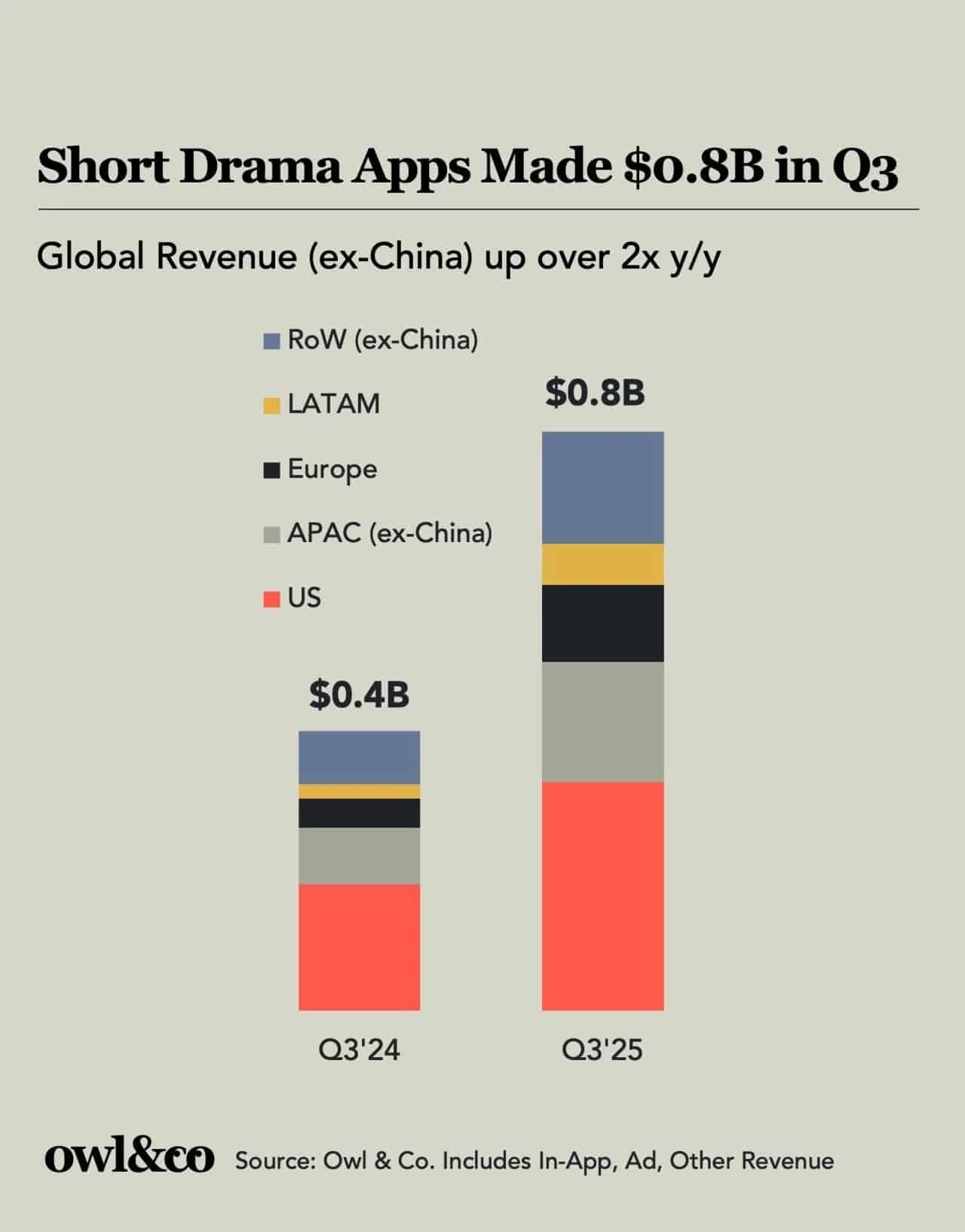

Think of a story that starts, hooks you, and finishes before your next scroll — that’s the promise of the microdrama. In Asia, over the past two years, those 30–90 second serials have gone from a niche format to a full-blown industry: China’s micro-drama market alone jumped to roughly ¥37.4 billion (about US$5.3 billion) in 2023 and, by some estimates, could top ¥100 billion within a few years.

Mobile-first habits and rising short-video use mean audiences are primed for snackable narrative: platforms that host short dramas report massive reach and engagement (one report puts short-drama penetration on Douyin at about 66% of users).

ByteDance’s Hongguo short-drama service drew 122 million monthly active users in under a year, a sign that formats optimised for the phone can reach mass audiences rapidly.

To learn more about microdramas and how the industry is shifting its focus to produce more mobile-friendly video content, Resonate spoke to Timothy Oh, General Manager at COL (China Online) – a leader in microdrama content.

With over 100 microdramas on their platform, FlareFlow, and microdramas being their only content, COL is not only an industry leader in the space, but is arguably a pioneer of the short-style drama. “We started microdramas back in 2021,” Oh says.

COL wasn’t pivoting away from long-form. They were recognising something everyone in Asia already knew: the phone had won.

“With the evolution of how people watch — moving from TV screens to mobile phones, which are now the first screens — consumption habits have completely changed,” Oh says. TikTok and Instagram Stories — they reshaped how people expected to consume video. “But what hadn’t happened before micro dramas was the monetization of that format.”

And once monetised, it took off.

Why Microdramas Hit Different in Asia

People don’t watch microdramas because they’re short. They watch them because they complete something — a beat, a cliffhanger, an emotional hit — in the exact amount of time you make instant noodles.

“With long-form shows… it’s frustrating to pause midway — it feels incomplete,” Oh says. “But with short episodes, you can binge six in a six-minute break and actually feel satisfied.”

In China specifically, microdramas didn’t emerge from a cultural vacuum. They grew out of web novels — the same sprawling, addictive digital fiction ecosystem. “Micro dramas are actually an extension of the web novels,” Oh explains. “They already have dedicated audiences who follow them closely.”

Fans were already primed for fast emotion, fast plot, and fast character arcs. Microdramas simply brought that to video. “One of the reasons they’ve found so much success is their wealth of IPs from novels. Micro dramas are actually an extension of the web novels that became hugely popular there,” he added. “You can think of these web novels as similar to webtoons in Korea — they already have dedicated audiences who follow them closely. Micro dramas became a way for those stories to be adapted and brought to life on screen.”

Fast to Shoot, Faster to Scale

Microdramas are also built for speed — in every sense.

They’re cheap compared to traditional TV, typically costing US$100,000 to US$200,000 per series. That’s intentional. “Using good-looking, unknown actors instead of celebrities creates a sense of realism,” Oh says. “You feel more emotionally connected… rather than seeing it as just another performance.”

Production moves at the kind of pace that would give Western studios whiplash. Vertical framing means a single room can become a hospital, an office, and a bedroom in under an hour. “We can shoot everything in about seven days and get it fully edited in another seven,” Oh says. “The whole production can be wrapped up within a month.”

At Singapore’s Asia TV Forum & Market 2025, COL CTO Enoch Chen put it simply: the audience is the co-writer.

“We focus on stories that resonate with our core audiences,” he said. “User data guides every decision… we monitor it daily as a continuous feedback loop.”

Characters, tropes, pacing — everything is adjusted in real time. Underperforming storylines vanish almost overnight. High-performing ones get sequelised, expanded, remixed.

It’s not just content creation — it’s content engineering.

Read more: K-Drama’s $2.5 Billion Bet: How a Geopolitical Crisis Forced South Korea into Netflix’s Global Orbit

Then there’s the role of AI — which, in Shanghai and Shenzhen production circles, is no longer optional.

COL has built a tool called Shao Yao to speed up scripting and story iteration. Some series on their app even feature AI-generated characters so humanlike you wouldn’t know the difference. For Oh, AI isn’t a replacement for creativity; it’s a sandbox.

“With a $20,000 budget… with AI, that same $20,000 could take the story to outer space,” he says. “AI enhances imagination.”

And perhaps more importantly, AI lets them test storylines before committing to a full shoot — a luxury no traditional series enjoys.

Does Microdrama Travel? Depends on Where You’re Flying

As the format expands beyond Asia, COL has learned that global audiences are far from uniform.

“In the US, the content from China translates surprisingly well,” Oh says. Latin America resonates for similar reasons — melodrama is part of the cultural DNA. “Americans love that over-the-top drama… so do audiences in Latin America.”

The UK, however, is trickier. “British humor doesn’t always land the same way,” Oh admits. The soap-adjacent melodrama of Chinese microdramas can feel too heightened for viewers raised on dry wit and tense silences.

Localization isn’t just language — it’s tuning emotion.

Marcus Zhang from Hony Capital believes microdramas are “one of the few genuinely new formats in mobile entertainment.” And despite their global spread, he points out the scoreboard still tells one story: China leads.

“Ranking tables consistently show the top two spots held by the same two firms,” he said, highlighting the content libraries and supply chains that Shanghai, Beijing, and Hangzhou built long before the rest of the world noticed.

For Zhang, the key is repeatability. “A single breakout hit is not impressive,” he says. What matters is a “repeatable content and IP engine” — essentially, a studio that behaves like a tech startup.

And generative AI, he stresses, is non-negotiable: “It is critical that a company thinks deeply about this space and remains open and adaptable.”

The Future: Choose-Your-Own-Melodrama

Oh believes the next chapter of microdramas will be interactive — a marriage between K-drama sensations, mobile storytelling apps, and gaming mechanics.

“One major trend will be gamification,” he says. Early prototypes already allow viewers to choose how characters respond to situations — determining how many episodes a protagonist “survives.”

For all the billion-dollar numbers and massive view counts, Oh insists the format is nowhere near maturity. Genres are expanding; Hollywood is sniffing around; Southeast Asia is finding its voice.

Read more: We Sat Down With Tony Leung To Discuss Trust, Technique… And Trees

“We might start seeing the Stranger Things of micro dramas next year,” he says — the kind of tentpole IP that defines an entire format.

And if that happens, it likely won’t start on a big screen, or even a laptop. It’ll start the way most new Asian cultural phenomena do: vertically, on a phone, in the two minutes before your next meeting.